I’m sure there had been times when you pay your bill with credit, this cashless and handy card is only good to swipe when you’e paying in bulk and you can’t afford to bring a huge amount of money. By creating a budget you can track where your money is going and define which expenses are essential, and which ones youre better off curbing. Missing out this step can cost you a lot of money you can’t have everything you want, but you can set aside 10 percent of your income to pay for what you want the most and set aside the other percentage for basic necessities. Short-term savings plan means reserving money at a bank for emergencies, while long-term savings refer to savings for retirement such as an insurance. Have a short-term and long-term savings plan.

Blue Red and Green Simple Modern Budget Planner. Pastel Orange and Purple Playful Monthly Budget Tracker Bullet Journal. Keeping track of your expenses on a regular basis and you will know if you’re making progress in control your money or if you’re slowly moving towards the direction of debt. Beige Aesthetic Financial Planner A4 Document. If you are parents combining your money for your children’s tuition or an accounting personnel handling a company’s budget, you can maximize the use of our printable budget planner template by knowing these secrets to good budgeting: Money is hard to come by these days, and having one income doesn’t cut it. What are hindrances to my goals? Could it be fear of letting go of a bad habit or aiming higher? Leave those fears or distractions behind.Ī variety of our budget templates like the Daily Budget Planner Template and Monthly Budget Planner Template will help you consistently reach your financial goals.it’s high time that you sort your budget, daily, weekly, and even up to a year. What’s my budget? Every day we spend time, effort, and money. By using a budget planner, you could: See where you might be able to cut costs and save money Prepare for the future and meet your financial goals Reduce or.Financial goals should be long term, and there has to be consistent money-generating incomes. How am I going to achieve it? The secret lies in how much discipline are you going to invest in achieving your financial goals.What’s my financial goal? Is it earning a six-figure income? Becoming a millionaire? Name it and work out on that plan.In order for you to reach your financial goal, you need to ask yourself these questions: Most people look for this and end up spending more that they can earn and end up in debt because of the the lack of knowledge in budgeting. Make sure you print the results if you want to keep them.

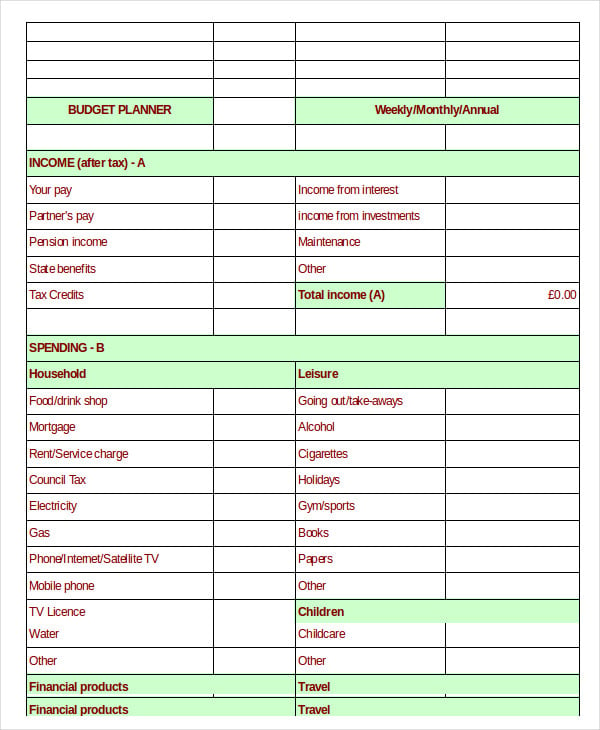

You can take as much time as you need, but you won’t be able to save your information. This budget planner makes it easy to get started. This budget tool takes at least 30 minutes to complete. Budgeting is one of the best ways to keep your finances on track. Make sure you include all your expenses, for example money you spend on your partner or family. Money isn’t just about saving for a sunny day, it’s about achieving financial freedom. receipts for things you usually pay for in cash.

0 kommentar(er)

0 kommentar(er)